Home and remote work: what’s the difference

In order to continue business in any conditions, employers transfer employees to remote forms of work: remote or home. The central interregional department of the

In order to continue business in any conditions, employers transfer employees to remote forms of work: remote or home. The central interregional department of the

From June 13 to 19, student and PhD student of the Department of Accounting and Taxation Alona Badai and Mariia Solodukha took part in the youth exchange

I sincerely congratulate the teachers, students and graduates of Sumy State University on an outstanding date – the 75th anniversary of its foundation. I am

The Law on Indexation has been suspended for the time being only for 2023. This is stated in Clause 3 of the Final Provisions of

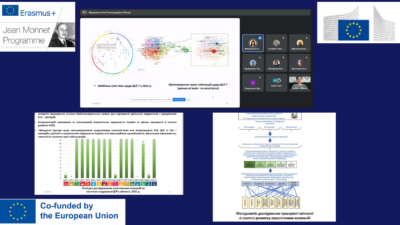

On September 19, 2023, the cycle of open lectures and seminars “Science for Sustainable Development” continued at the Department of Accounting and Taxation within the

On the occasion of the 75th anniversary of the founding of Sumy State University, please accept our sincere congratulations and words of gratitude for the

September 14, 2023 – an online meeting with Yelyzaveta Ahafonova, the accountant of the “YURYST I BUKHHALTER” LLC (and the bachelor-to-be of our department) took place.

Even in summer, our students and postgraduates traveled and studied! From June 25 to July 1, 2023, students of the Department of Accounting and

Fulfillment of the tax obligation can be carried out by the taxpayer independently or with the help of his representative or tax agent. According to