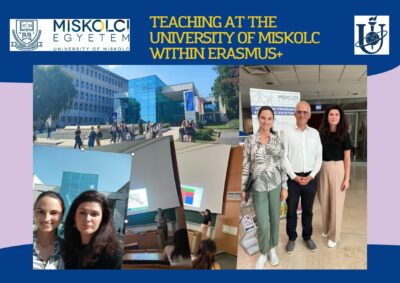

PARTICIPATION OF A STUDENT OF THE DEPARTMENT OF ACCOUNTING AND TAXATION IN A SUMMER SCHOOL IN WROCLAW

From 16 to 23 September 2023, a student majoring in 071 “Accounting and Taxation”, Tetiana Rugal, took part in the Summer School within the framework of the project