When will the new Schengen entry rules come into effect?

Citizens of third countries will soon stop having their passports stamped at the border when entering the Schengen area without a visa. The information will

Citizens of third countries will soon stop having their passports stamped at the border when entering the Schengen area without a visa. The information will

Subsidy is targeted assistance provided to cover the costs of paying for housing and communal services. It is appointed if the income of the residents

The calculation of the average daily wage for the provision of assistance in connection with temporary disability is carried out in accordance with the norms

The government approved the budget of the Mandatory State Social Insurance Fund for Unemployment for 2023, which provides for spending on the implementation of active

Amounts of VAT included in the tax credit when carrying out transactions for the purchase of goods, which were subsequently destroyed (lost) due to force

The first optional class for teachers in 2023 took place on January 27. Senior lecturers of the Department of Accaunting and Taxation, Zhanna Oleksich and

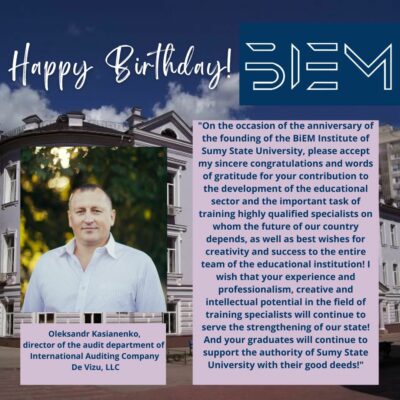

“On the occasion of the anniversary of the founding of the BiEM Institute of Sumy State University, please accept my sincere congratulations and words of

«Today is a significant day for our institute, because it is here that a constellation of highly qualified accountants, auditors, financiers, bankers and other specialists

According to Art. 27 of the Labor Code, the probationary period for employment, unless otherwise established by the legislation of Ukraine, may not exceed three