WHO IS ENTITLED TO SICK PAY IN THE AMOUNT OF 100% OF THE AVERAGE SALARY

PFU informs that in accordance with the Law of Ukraine “On Mandatory State Social Insurance”, temporary disability benefits are paid to insured persons in the

PFU informs that in accordance with the Law of Ukraine “On Mandatory State Social Insurance”, temporary disability benefits are paid to insured persons in the

Institution, enterprise, non-bank provider of payment services on the basis of the Regulation on conducting cash transactions in the national currency in Ukraine, approved by

The official results of the main session of the NMT will be posted in the personal offices of the participants until June 28, since the

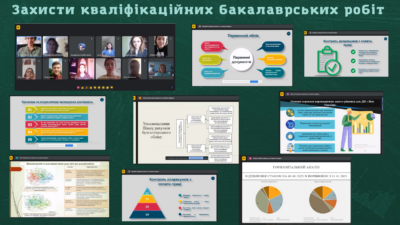

On June 22, 2023, bachelor’s theses were defended by full-time students majoring in 071 Accounting and Taxation. The presented bachelor’s theses were devoted to relevant

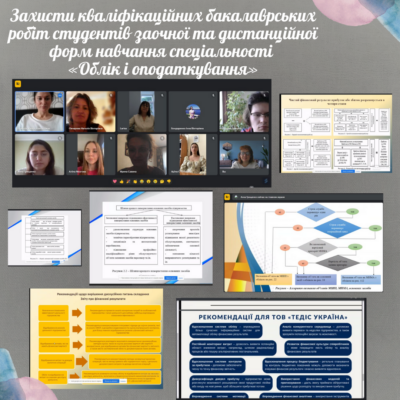

On June 21, 2023, the bachelor’s theses of part-time and distance learning students majoring in 071 “Accounting and Taxation” were defended. The students demonstrated a

The Head of the Department of Accounting and Taxation, Yulia Serpeninova, took part in the academic mobility program in the form of teaching at the

The Ukrainian Center for Evaluation of the Quality of Education intends to find and annul the results of applicants who violated the procedure for conducting

By Order No. 310 dated June 9, 2023, the Ministry of Finance approved changes to some methodological recommendations on accounting for public sector entities, approved

Daily expenses from the day of the last transfer to another vehicle (departure from a hotel, motel, other residential premises) on the territory of Ukraine