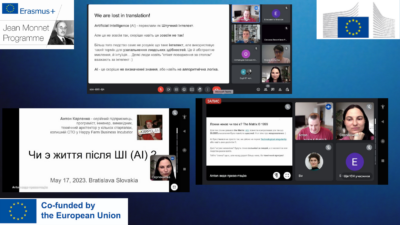

The series of virtual classes ” EU-Ukraine best practice towards SDGs progress” as part of the implementation of the Jean Monet Erasmus project continues

On May 17, 2023, the third virtual classes “EU-Ukraine best practice towards SDGs progress” were held at the Department of Accounting and Taxation of Sumy