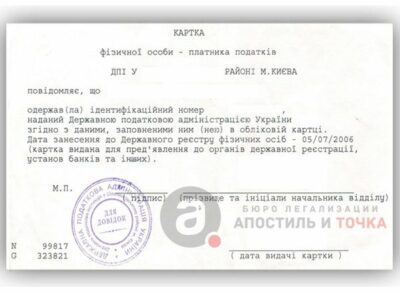

In accordance with clause 70.9 of the Code of Civil Procedure and clause 7 of ch. VII Regulation on the registration of natural persons in the State register of natural persons – taxpayers, approved by order of the Ministry of Finance dated 29.09.2017 No. 822 (as amended, hereinafter – Regulation No. 822), at the request of a natural person or his representative, the controlling body issues a document certifying registration in the State Register of Individuals – Taxpayers (hereinafter – SRIT) (taxpayer card (Appendix 3 to Regulation No. 822)), in accordance with the procedure defined by Regulation No. 822 (except for persons who, due to their religious beliefs, refuse to accept the registration number of the cards of the taxpayer and notified the relevant tax authority and have a mark in the passport). The registration number of the taxpayer’s account card is indicated in such a document.

If it is necessary to re-obtain a document certifying registration in the SRIT, due to the loss or damage of such a document, a natural person – taxpayer submits to the tax authority an application for making changes to the State Register of natural persons – taxpayers in form No. 5DR (hereinafter – Application for f. No. 5DR) (Appendix 12 to Regulation No. 822).

Individuals submit an Application under f. No. 5DR in person or through a representative to the supervisory authority at your tax address (place of residence), and in case of a change of residence – to the supervisory authority at the new place of residence or to any supervisory authority (Clause 2, Chapter IX of Regulation No. 822).

To fill out the Application under f. No. 5DR uses the data of the identity document and other documents that confirm changes to such data (clause 3, chapter IX of Regulation No. 822).

According to paragraphs 4 p. 1 ch. III Regulation No. 822, to confirm information about the declared (registered) place of residence (stay), a person submits one of the following documents:

– extract from the territorial community register;

– a passport made in the form of a book;

– temporary certificate of a citizen of Ukraine.

In order to confirm the fact of internal displacement and registration of an internally displaced person, such a person submits a certificate of registration of an internally displaced person in accordance with the Procedure for issuing and issuing a certificate of registration of an internally displaced person, approved by Resolution of the CMU dated 01.10.2014 No. 509 “On Registration internally displaced persons” (item 5, item 1, chapter III of Regulation No. 822).

Documents can also be submitted through centers for the provision of administrative services (clause 6, chapter III of Regulation No. 822).

In case of loss of the document certifying registration in the SRIT, an individual must submit an Application under f. No. 5DR to the controlling body at your tax address (place of residence) or to any controlling body or center for the provision of administrative services, present your passport and, if necessary, an extract from the register of the territorial community about the declared (registered) place of residence (stay) of a person.

In accordance with Part 9 of Art. 16 of the Law of Ukraine dated November 20, 2012 No. 5492-VI “On the Unified State Demographic Register and documents confirming the citizenship of Ukraine, certifying a person or his special status” (as amended, hereinafter – Law No. 5492), provides that instead of lost or stolen of a document (including a passport of a citizen of Ukraine), the authorized entity, unless otherwise provided by Law No. 5492, after establishing the fact of earlier issuance of such a document to the person who reported its loss or theft, issues and issues a new document.

In case of loss (damage) of the document certifying registration in the SRIT, if the passport of a citizen of Ukraine is also lost, a natural person must:

– obtain a new passport of a citizen of Ukraine, instead of a lost or stolen one, from the territorial body of the State Migration Service of Ukraine in accordance with the established procedure;

– submit to the supervisory body at your tax address (place of residence) or to any supervisory body or center for the provision of administrative services the Application under f. No. 5DR, present a passport and an extract from the register of the territorial community about the person’s declared (registered) place of residence (stay);

– obtain a document certifying registration in the SRIT in the supervisory body at your tax address (place of residence) or to any supervisory body by presenting your passport.