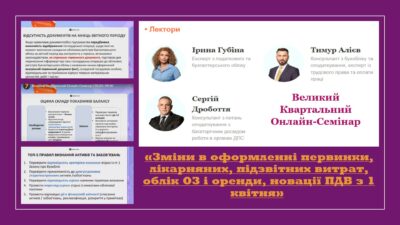

March 29, 2023 – masters-to-be majoring in “Accounting and Taxation” joined the Great Quarterly Online Seminar on the topic “Changes in the registration of first aid, hospital, accountable expenses, accounting of health care and rent, VAT innovations from April 1”.

The online seminar was conducted by Iryna Gubina, Timur Aliiev and Serhii Drobottia, leading experts, consultants on tax and accounting, and labor law.

During this seminar, students had the opportunity to receive practical, up-to-date information on the following issues:

- What additional document is required in case of non-cash payments of the accountable person?

- What will be the new deadlines for submitting supporting documents?

- What to pay attention to in the new list of supporting documents for travel expenses?

- What administrative document should be drawn up for the appointment of sick leave?

- How to display paid and unpaid sick days in the time sheet?

- What has changed in the TB and VAT declaration forms and when should the updated forms be used?

- Who is allowed to submit additional documents to unlock the TB?

- How have the terms of registration of adjustment calculations in the TB and the amounts of fines changed?

- How can an accountant close a period if the counterparty does not provide documents on time?

The organizer is Nataliia Ovcharova, the Senior Lecturer of the Department of Accounting and Taxation.

Thanks for useful, relevant and interesting information.