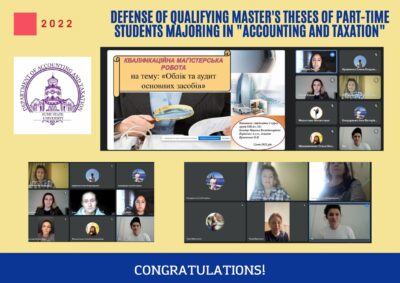

Defense of qualifying master’s theses of part-time students majoring in “Accounting and Taxation”

December 20, 2022 – the defense of qualifying master’s theses of part-time students majoring in “Accounting and Taxation” took place in an on-line form. The